A few weeks ago I gave a presentation about legal blogging to the Ohio Women’s Bar Association Leadership Institute. During my talk the question arose of whether I’ve ever made a mistake, and, if so, how I handled it. I spoke of one incident when something I had written was incorrect. I also spoke of the importance of transparency with my readers, and my willingness to fall on my sword and admit that I was wrong (my wife will tell you this isn’t always easy for me).

Today is post number 1,365 (yikes). When you write as much as I do, something is bound to fall through the cracks every now and again. An astute reader pointed out an omission from Monday’s post on holiday pay. I wrote that because paid holidays are discretionary, there is no legal requirement that you have pay non-exempt employees for holidays off. That statement is true, but not if you pay the non-exempt employee a fixed salary pursuant to a fluctuating workweek calculation. In that instance, you must pay the employee for any holidays off, or risk the fluctuating workweek status and the overtime calculation benefits that come with it. For more on the fluctuating workweek, I recommend Robert Fitzpatrick’s excellent white paper [pdf] on the topic.

The way I figure it, I’m batting .999, MVP-like numbers no matter how you slice it.

Here’s the rest of what I read this week:

Discrimination

- Has the Expanded Definition of Disability under the ADAAA Gone Too Far? — from Russell Cawyer’s Texas Employment Law Update

- With DSM-5 on the Way, Is It Time to Update Definition of “Mental Disability”? — from Dan Schwartz’s Connecticut Employment Law Blog

- Supervisor’s advice to sexually-harassed employee: “Pray…” — from Eric Meyer’s The Employer Handbook Blog

- Asking for a doctor’s note explaining a health-related absence can violate the ADA — from Warren & Associates Blog

- Employee’s inability to work overtime is not a per se disability under the ADA — from Employment Law Matters

- 12 Tips to Lower Legal Bills, Assist Lawyer in Employment Disputes — from HR Hero Line

- Lent, Catholicism, Religious Accommodations — from LaborRelated

- Title VII and Contraceptive Coverage — from The Proactive Employer Blog

- Why Genetic Discrimination Is Illegal — from Time

Social Media & Workplace Technology

- Social Media Policies: The Latest — from Manpower Employment Blawg

- Tech Co Daxko’s Social Media Policy Like TV’s Tattoo — from Fistful of Talent

- Why corporate Facebook policies are stupid — from Jay Shepherd’s Gruntled Employees

- Social Media And The Fight To Be First — from Social Media Employment Law Blog

HR & Employee Relations

- Employee Handbooks Revisited: Damned If You Do, Damned If You Don’t — from Mike Haberman’s Omega HR Solutions

- Promoting a Culture of Security: Is It the Most Important Step in Protecting Trade Secrets? — from Trade Secret Litigator Blog

- When is it okay to quit without giving notice? — from The Evil HR Lady, Suzanne Lucas

Wage & Hour

- Exploring an Employer’s Obligations to Pay Accrued Vacation and Severance under Michigan Law — from Jason Shinn’s Michigan Employment Law Advisor

- When is the Minimum Wage Not the Minimum Wage? — from Stephanie Thomas at Compensation Cafe

- Another Call Center Case Focuses On Off The Clock Working Time — from Wage & Hour - Development & Highlights

- IRS to Employers: Raise Your Hand If You’ve Misclassified Workers — from Delaware Employment Law Blog

- Summary of 2011 FMLA Cases: Valuable Resource to Employers — from Jeff Nowak’s FMLA Insights

- Stephen Colbert Provides Reminder That Family Medical Leave Is Not A Laughing Matter — from California Employment Law Report

- DOL’s “Updated” FMLA Forms List New 2015 Expiration Date — from New York Labor and Employment Law Report

Labor Relations

- By George! Here’s an angle on NLRB/social media that I bet you haven’t thought of — from Robin Shea’s Employment and Labor Insider

- Research Reveals How Labor Unions Use Social Media — from Jessica Miller-Merrell’s Blogging4Jobs

- Your Position at the Bargaining Table May Open the Door to a Broad Request for Information From the Union — from Trade Secret / Noncompete Blog

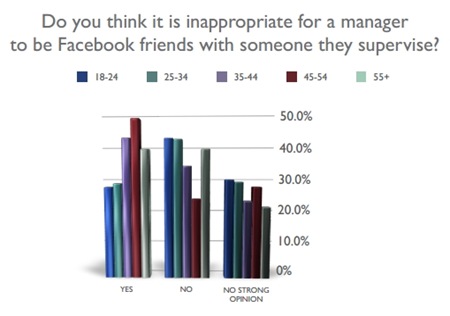

Only 28% of employees ages 18-34 believe it is inappropriate to friend their supervisor on Facebook. The number rises to nearly 50% for those ages 45 and up.

Only 28% of employees ages 18-34 believe it is inappropriate to friend their supervisor on Facebook. The number rises to nearly 50% for those ages 45 and up.