"We are looking for volunteers for our new Drive Thru Express!🚘 Earn 5 free entrees per shift (1 hr) worked. Message us for details"

Thursday, July 28, 2022

Unlike ordering at Chick-Fil-A, legal compliance isn’t chosen from a menu.

"We are looking for volunteers for our new Drive Thru Express!🚘 Earn 5 free entrees per shift (1 hr) worked. Message us for details"

For more information, contact Jon at (440) 695-8044 or JHyman@Wickenslaw.com.

Do you like what you read? Receive updates two different ways:

Subscribe to the feed or register for free email updates.

Thursday, May 12, 2022

Let’s play spot the issue

Let's see if you can spot the employment law issue from this story, which I've borrowed from our local police blotter.

On April 26, the owner of a bar came to the police station regarding an ex-employee who stole his daughter's AirPods.

The stealing incident, which took place in February, led the owner to track the pods to a house that just so happened to be the home of the ex-employee's sister.

That's when the owner told the employee he was withholding his last check to cover the cost of the AirPods.

The man needed a police report to document the incident and provide the state justification of docking the ex-employee $250 from his last paycheck.

What do you think?

For more information, contact Jon at (440) 695-8044 or JHyman@Wickenslaw.com.

Do you like what you read? Receive updates two different ways:

Subscribe to the feed or register for free email updates.

Tuesday, April 26, 2022

Restaurant learns the hard way what an illegal tip pool looks like

Hard Eight BBQ says it misunderstood its obligations under the Fair Labor Standards Act by paying managers a share of tips earned by servers across the restaurant's five locations. As a result, following a Department of Labor investigation it reached a settlement with its managers totaling $867,572.

Matt Perry, COO of Hard Eight BBQ, told 5 NBCDFW that "managers were part of the tip pool at their five restaurants because they do the same jobs as other hourly employees on any given shift and that because of that they felt like managers should also receive a small portion of the tip share."

For more information, contact Jon at (440) 695-8044 or JHyman@Wickenslaw.com.

Do you like what you read? Receive updates two different ways:

Subscribe to the feed or register for free email updates.

Thursday, April 14, 2022

Ohio enacts sweeping changes to state wage and hour laws

Beginning July 6, 2022, Ohio employers have a new set of rules under which to pay their employees.

SB 47 revamps Ohio's wage and hour statute to correct some major differences that have historically existed between it and the federal Fair Labor Standards Act.

For more information, contact Jon at (440) 695-8044 or JHyman@Wickenslaw.com.

Do you like what you read? Receive updates two different ways:

Subscribe to the feed or register for free email updates.

Thursday, April 7, 2022

Don’t confuse “tips” and “service charges” for hospitality employees

How often have you looked at you bill at a restaurant and have seen an added service fee? Do you think to yourself, "No need to tip; it's already been added to the bill."

For more information, contact Jon at (440) 695-8044 or JHyman@Wickenslaw.com.

Do you like what you read? Receive updates two different ways:

Subscribe to the feed or register for free email updates.

Monday, March 21, 2022

I’m going to say this loudly for the people in the back: IT’S ILLEGAL FOR EMPLOYEES TO WORK FOR FREE

I woke up Saturday morning to a tweet asking me for my take on this job posting.

For more information, contact Jon at (440) 695-8044 or JHyman@Wickenslaw.com.

Do you like what you read? Receive updates two different ways:

Subscribe to the feed or register for free email updates.

Thursday, March 10, 2022

Local bag company learns an expensive lesson on wage and hour compliance

A federal judge has ordered American Made Bags to pay $189,756 to a group of 48 employees, half as unpaid wages and half as liquidated damages.

For more information, contact Jon at (440) 695-8044 or JHyman@Wickenslaw.com.

Do you like what you read? Receive updates two different ways:

Subscribe to the feed or register for free email updates.

Wednesday, March 9, 2022

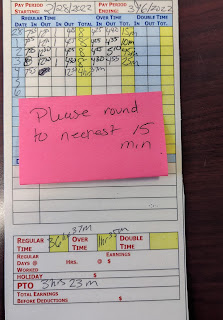

The wage and hour risks of rounding

"Iraene" asks the following question on the Antiwork subreddit.

I was told to round down or round up my time. So if I start work at 7:55 I need to put 8. If I work 37 minutes, I should round down to 30, instead of 45 because this is a common business practice. Is this normal? I have entered exact times on the card and into ADP so idk why it's a problem now.

For more information, contact Jon at (440) 695-8044 or JHyman@Wickenslaw.com.

Do you like what you read? Receive updates two different ways:

Subscribe to the feed or register for free email updates.

Wednesday, February 23, 2022

Tip credits and tip pools — the tip of the FLSA iceberg

No employment law is more misunderstood and misapplied by employers than the Fair Labor Standards Act, our federal wage and hour law. There are more than 8,000 federal FLSA lawsuits filed per year, with nearly one-quarter filed against employers in the accommodation and food service industry … including craft breweries.

These employers get themselves in legal trouble because of the special manner in which service industry employees are compensated. If you employ workers who customarily and regularly receive more than $30 a month in tips (and every craft brewery does), there are two key FLSA phrases you must understand to avoid FLSA landmines — tip credit and tip pool.

For more information, contact Jon at (440) 695-8044 or JHyman@Wickenslaw.com.

Do you like what you read? Receive updates two different ways:

Subscribe to the feed or register for free email updates.

Wednesday, January 12, 2022

Pumping up workplace lactation rights

The U.S. Department of Labor has reached a settlement with Labcorp over allegations that it failed to provide lactating employees a space for them to express milk privately without fear of intrusion.

The investigation stemmed from an allegation of one employee in the company's Lynwood, California, location. DOL investigators determined that when the employee asked for a private place to express her breast milk, supervisors offered a common space that resulted in her being interrupted twice. As result, and per its settlement with the DOL, Labcorp has agreed, for all of its 2,000-plus locations nationwide, to "provide a private space as required with a notification on the door to guarantee an intrusion-free space."

For more information, contact Jon at (440) 695-8044 or JHyman@Wickenslaw.com.

Do you like what you read? Receive updates two different ways:

Subscribe to the feed or register for free email updates.

Monday, January 10, 2022

The “Penny Pincher” gets sued for retaliation — an update on a 2021 Worst Employer finalist

A OK Walker Autoworks and its owner, Miles Walker, a 2021 Worst Employer finalist, finished dead last in last year's voting, garnering only 7% of the total weighted vote. They may win the prize after all, however. The Department of Labor just filed a lawsuit against the auto repair shop and its owner for retaliation under the Fair Labor Standards Act.

For more information, contact Jon at (440) 695-8044 or JHyman@Wickenslaw.com.

Do you like what you read? Receive updates two different ways:

Subscribe to the feed or register for free email updates.

Thursday, September 9, 2021

Coronavirus Update 9-9-21: Don’t forget about overtime laws when paying employees pandemic-related bonuses

If you pass any restaurant these days you'll almost certainly see a sign like this one:

"Now hiring: $________ sign-on bonus."

I've seen that blank filled in with numbers as high a $1,000 to work at a fast-food restaurant.

Employers are paying these bonuses because they continue to struggle to fill job vacancies in the tightest and toughest labor market I've ever witnessed.

If you find yourself in this position, do not forget about the wage and hour implications of these bonus payments, specifically their inclusion in the "regular rate" for purposes of calculating an employee's overtime premium.

For more information, contact Jon at (440) 695-8044 or JHyman@Wickenslaw.com.

Do you like what you read? Receive updates two different ways:

Subscribe to the feed or register for free email updates.

Thursday, July 15, 2021

There’s nothing illegal about paying employees a “day rate,” as long as you also pay an overtime premium for overtime hours

Here's how the president of Fusion Japanese Steakhouse describes the manner in which his company (unlawfully) pays its kitchen staff:

I pay a teriyaki chef $120 per day. He worked ten hours—ten hours a day. So here’s how to calculate it. He works ten hours a day at $120 a day. I divide it by hours, and it’s $10.97 per hour. If he works overtime, it will be $16.20 overtime pay. So $120 a day, I have it covered because it was way past—way beyond $7.25 minimum wage rate. So I take consideration of the industry standard, you know. So either it is for teriyaki chef, it is $120 or $120 per day.In other words, as the court correctly surmised in Walsh v. Fusion Japanese Steakhouse, the employer "works backward to calculate the hourly rate of the employees based on the day rate." That backward calculation, however, to jerry-rig an hourly rate plus and overtime rate to arrive at the agreed-upon day rate, is not legal.

For more information, contact Jon at (440) 695-8044 or JHyman@Wickenslaw.com.

Do you like what you read? Receive updates two different ways:

Subscribe to the feed or register for free email updates.

Wednesday, April 28, 2021

Biden Administration announces $15 minimum wage for all federal contractors

Yesterday, the White House announced that effective January 30, 2022, all federal contractors will be required to incorporate a $15 minimum wage in new contract solicitations, and by March 30, 2022, all federal agencies will need to implement the minimum wage into new contracts and into existing contracts with annual options to renew.

The Executive Order that implements these changes will also tie this new minimum wage to inflation and adjust accordingly annually, eliminate the tipped minimum wage for federal contractors by 2024, and extends the required $15 minimum wage to federal contract workers with disabilities.

For more information, contact Jon at (440) 695-8044 or JHyman@Wickenslaw.com.

Do you like what you read? Receive updates two different ways:

Subscribe to the feed or register for free email updates.

Wednesday, April 14, 2021

DOL reopens the floodgate to liquidated damages in wage and hour investigations

The Department of Labor's breakup with liquidated damages in wage and hour investigations lasted only four years. Late last week, the agency announced that it would again seek liquidated damages (an amount equal to the unpaid wages themselves) in investigations, undoing a policy change made by the Trump administration.

For more information, contact Jon at (440) 695-8044 or JHyman@Wickenslaw.com.

Do you like what you read? Receive updates two different ways:

Subscribe to the feed or register for free email updates.

Monday, February 8, 2021

Have you felt the pain of a wage/hour investigation or lawsuit?

For the past three years, the Department of Labor has been trying to get employees PAID for their unpaid overtime and minimum wages. That's PAID, as in the Payroll Audit Independent Determination program, a creation of the Trump administration that allowed employers to self-report FLSA violations to the Department of Labor without risk of litigation, enforcement proceedings, or liquidated damages.

For the past three years, the Department of Labor has been trying to get employees PAID for their unpaid overtime and minimum wages. That's PAID, as in the Payroll Audit Independent Determination program, a creation of the Trump administration that allowed employers to self-report FLSA violations to the Department of Labor without risk of litigation, enforcement proceedings, or liquidated damages.For more information, contact Jon at (440) 695-8044 or JHyman@Wickenslaw.com.

Do you like what you read? Receive updates two different ways:

Subscribe to the feed or register for free email updates.

Monday, January 18, 2021

What employers can expect from Biden’s presidency: A $15 minimum wage

This week I'll be examining what employers can expect from Joe Biden's presidency. Today, a $15 minimum wage.

Late last week President-elect Biden released his America Rescue Plan, a comprehensive legislative package to provide relief to those struggling because of COVID-19. Among its proposals was a $15 minimum wage.

For more information, contact Jon at (440) 695-8044 or JHyman@Wickenslaw.com.

Do you like what you read? Receive updates two different ways:

Subscribe to the feed or register for free email updates.

Wednesday, September 23, 2020

DOL publishes proposed regulations that would make it easier for employers to classify workers as independent contractors

Yesterday, the U.S. Department of Labor announced a proposed rule amending its regulations on how to determine whether a worker is an employee covered by the Fair Labor Standards Act or an independent contractor not covered by the FLSA. This proposed rule is significant because the FLSA lacks clear guidance on these important definitions, which has left employers struggling, scrambling, and risk-taking to properly classify workers for purposes of paying overtime and other wage/hour obligations.

Yesterday, the U.S. Department of Labor announced a proposed rule amending its regulations on how to determine whether a worker is an employee covered by the Fair Labor Standards Act or an independent contractor not covered by the FLSA. This proposed rule is significant because the FLSA lacks clear guidance on these important definitions, which has left employers struggling, scrambling, and risk-taking to properly classify workers for purposes of paying overtime and other wage/hour obligations.For more information, contact Jon at (440) 695-8044 or JHyman@Wickenslaw.com.

Do you like what you read? Receive updates two different ways:

Subscribe to the feed or register for free email updates.

Wednesday, March 11, 2020

6th Circuit gives employers relief on the evidence employees must present to prove off-the-clock work

The difficulty in defending certain wage-and-hour cases is that employers are often asked to prove a negative. “I worked __ number of hours of overtime,” says the plaintiff employee. “Prove that I didn’t.” If the hours are for unclocked work, the employer often lacks documentation to refute the employee’s story. Which, in turn, leads to a case of "I worked / no you didn't." That, in turn, creates a jury question, the risk of a trial, and a settlement (since very few employers want to risk paying the plaintiff’s attorneys’ fees if the employee wins).

In Viet v. Le, the 6th Circuit Court of Appeals provides employers much needed relief from these extorting lawsuits.

For more information, contact Jon at (440) 695-8044 or JHyman@Wickenslaw.com.

Do you like what you read? Receive updates two different ways:

Subscribe to the feed or register for free email updates.

Wednesday, January 29, 2020

Chipotle settlement highlights child labor issues

According to CNN, Chipotle has agreed to pay a $1.3 million fine for more than 13,000 child labor violations at over 50 of its Massachusetts restaurants. The state’s attorney general’s office accused the company of forcing teenagers to work without proper work permits, late into the night, and for too many hours per day and week. It’s the largest child labor penalty in Massachusetts history.

For more information, contact Jon at (440) 695-8044 or JHyman@Wickenslaw.com.

Do you like what you read? Receive updates two different ways:

Subscribe to the feed or register for free email updates.